Profit and Loss Fundamentals for Business Leaders

I still vividly remember the first time my boss told me: “Tanguy, you’re in charge now. You’re the General Manager of this business unit. You own the P&L, don’t mess up”.

That’s about how much guidance and sound advice I got on “driving my P&L”! I was honored by the entrustment, but I made many mistakes and learned a few things that I wish I would have known when I started as a product and business leader.

P&L (Profit and Loss) responsibility is undoubtedly one of the essential duties of any executive role. It involves monitoring net income after expenses for a department or an entire organization and demands a delicate balance between revenue optimization and expense control. Unsurprisingly, executive recruiters actively search for candidates who have demonstrated successful P&L management.

I learned that you never really “own” your P&L as a business leader. Still, you have a significant influence, and there are particular aspects for you to watch. I also realized that obsessing over cost control can be fatal in times of crisis or turnarounds, as there are even more critical performance indicators for you to watch.

If you are an existing or aspiring business leader, let me share a mini guide on six P&L management fundamentals, what to pay specific attention to, and how to go the extra mile.

Basics first: P&L Anatomy 101

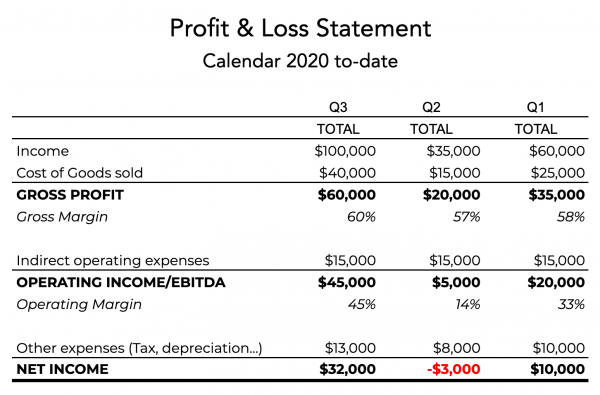

P&L (“Profit & Loss”) is one of the three most important financial statements for a business, along with the balance sheet and the cash flow statement. Think of it like a “video” summarizing how you managed revenue and expenses over time. Income and costs are the fundamental elements of your P&L, and depending on which one is higher, you will end up with a profit or a loss. But enough with the super basics!

While it’s always useful to qualify your revenue (physical products, services….), the categorization of expenses is critical to understand. Two kinds of expenses exist: direct and indirect. You can trace your direct costs directly to your products or services sold. We usually call these the cost of services or cost of goods (CoGs) and are typically variable. Which means they increase in direct proportion to the sales made. If you are running a manufacturing business, the direct variable costs would typically include your material costs and labor cost to manufacture.

When you deduct these direct variable costs from your revenue, you obtain your gross profit. It’s a great indicator of how efficient your production and sales processes are.

Then you have your indirect costs, which cannot be traced directly to the products or services sold. These can be fixed costs (salaries, rent, insurance…) or variable (advertising, sales commissions…). When you deduct such indirect expenses from your gross profit, you obtain your operating profit, also known as operating income, or EBITDA (Earnings Before Interests Tax Depreciation and Amortization).

You now have a basic P&L statement that you can use and compare between different periods. It’s pretty much what most P&L owners need to master as they usually don’t have much influence on accounting matters like tax and interests.

Great P&L owners know how to handle expenses

P&L management includes expense control. Great P&L owners will work with all the relevant teams to save and optimize costs. And when a crisis comes, you have a plethora of options to consider. But this can quickly become overwhelming and turn into cost micro-management. The most effective approach I experienced was focusing on the top suppliers and expense areas (Habit #1). From there, we would study what should be fixed costs (like salaries) vs. variable costs and optimize (Habit #2).

There’s no right or wrong answer, but the fundamental is that fixed costs help when you can scale, but they don’t offer much flexibility if you are struggling. Variable expenses are likely not as effective when you scale up, but they bring much more flexibility. It’s a good idea to see how you can convert more costs into variable costs in times of crisis. I’m not advocating that you lay off your whole team and hire great consultants instead! Still, look at how you can increase your flexibility by selling some of your assets and lease them back as an example.

The principle also applies to your COGs if you manufacture products. You can seek how to turn more of your non-recurring engineering costs (NRE) into variable costs. The levers will differ if you’re a SaaS-only business. Still, the principle of cost optimization remains the same. Take an audit of your key suppliers. Apply the 80/20 rule and focus on the top suppliers that fall under your P&L responsibility. Reconsider your major cost items with them for present and upcoming developments.

Revenue optimization has the most significant impact

Unfortunately, too many P&L owners tend to obsess over cost management. When things don’t go as planned, it is tempting (or requested) to go and cut costs to improve your net income. It reaches a point of diminishing return. So, make sure you pay attention to your business fundamentals. You will minimize the risk of cutting too far, which would lead to reduced innovation and eventual irrelevance.

I struggled with this too until I realized my most significant leverage on the bottom line of the P&L was how to optimize the revenue line. Here are the next four top approaches I’ve seen work well:

- Habit #3: Analyze your portfolio and eliminate “dogs”: in other words, your least profitable products, especially the ones that are in declining categories. I’ve seen too many instances where we didn’t have the courage to end-of-life a money-losing product line. There was always a good reason like a significant customer still relying on it, but it just dragged us down.

- Habit #4: Rethink your distribution strategy: you don’t need to sell your products everywhere! So, please work with your sales team on a clear articulation of your channel landscape, the key players, their operating mode for success, and your expected penetration. Once aligned on what the destinations of choice for your customers are, do they map to your current channel strategy?

- Habit #5: Be strategic about pricing. You worked hard, creating value and differentiation with your products. Value-based pricing is the way to extract maximum profit, as it forces you to rethink your segmentation and adapt your offering and price structure. By working with sales and marketing to align a credible story with your pricing model, you will maximize your impact.

- Habit #6: Lastly, along these lines, you should also optimize your customer lifetime value by identifying the best ways to up-sell or cross-sell your customers. The goal here is to keep improving your revenue and profit by focusing on your existing customers. They are your lowest hanging fruit.

In conclusion

Executive recruiters are right; the best business leaders know how to handle their P&L. The winners find a balance between expense management and revenue optimization. Most importantly, they know it’s a genuinely collective and cross-functional effort. Their reputation might be on the line, and they might “own” the P&L. Still, it’s the strength of their collaboration with all functions involved that makes the most outstanding leaders. Other key considerations can help business leaders, especially in times of crisis. For more, you can read my other article on “Times of Crisis: Should you Think like your CFO?“.

At The Product Sherpa, we consider P&L management is a fundamental skill that existing and aspiring leaders need to master. If you are getting to a point where you feel stuck and need more guidance to take the right actions or want to dig deeper into the topics covered in this article, reach out to me. I’ll be delighted to be that guide.